Peter Eikelboom, innovation manager at de Volksbank, explains. “The mortgage approval process at the Volksbank currently takes a couple of weeks: from the application to the signing of the mortgage deed at the notary. That has partly to do with the consultation, but also with collecting, sharing and checking data.

As a Dutch citizen, you need to provide a lot of information for a mortgage application, regarding income, expenses, loans and equity.

You must collect this data from many different sources, such as the Tax Authorities, BKR, UWV and DUO. Once this is done, you then share that personal information: you send the collected documents by email to de Volksbank.”

The documents de Volksbank receives about its customer often include data the bank does not need at all. Peter: “We don’t want to know all that much about the customer. Quite the contrary: we are working on data minimization.”

“We don’t want to know all that much about the customer. Quite the contrary: we are working on data minimization.”

De Volksbank must securely store and validate all data. Is everything correct and up-to-date? Is the customer really able to bear the mortgage burden? Time consuming to say the least. Also, all checks are done one step at a time. As a result, the customer only gets real certainty about the application at last check of the lengthy procedure.”

Things can be done differently with the Schluss app

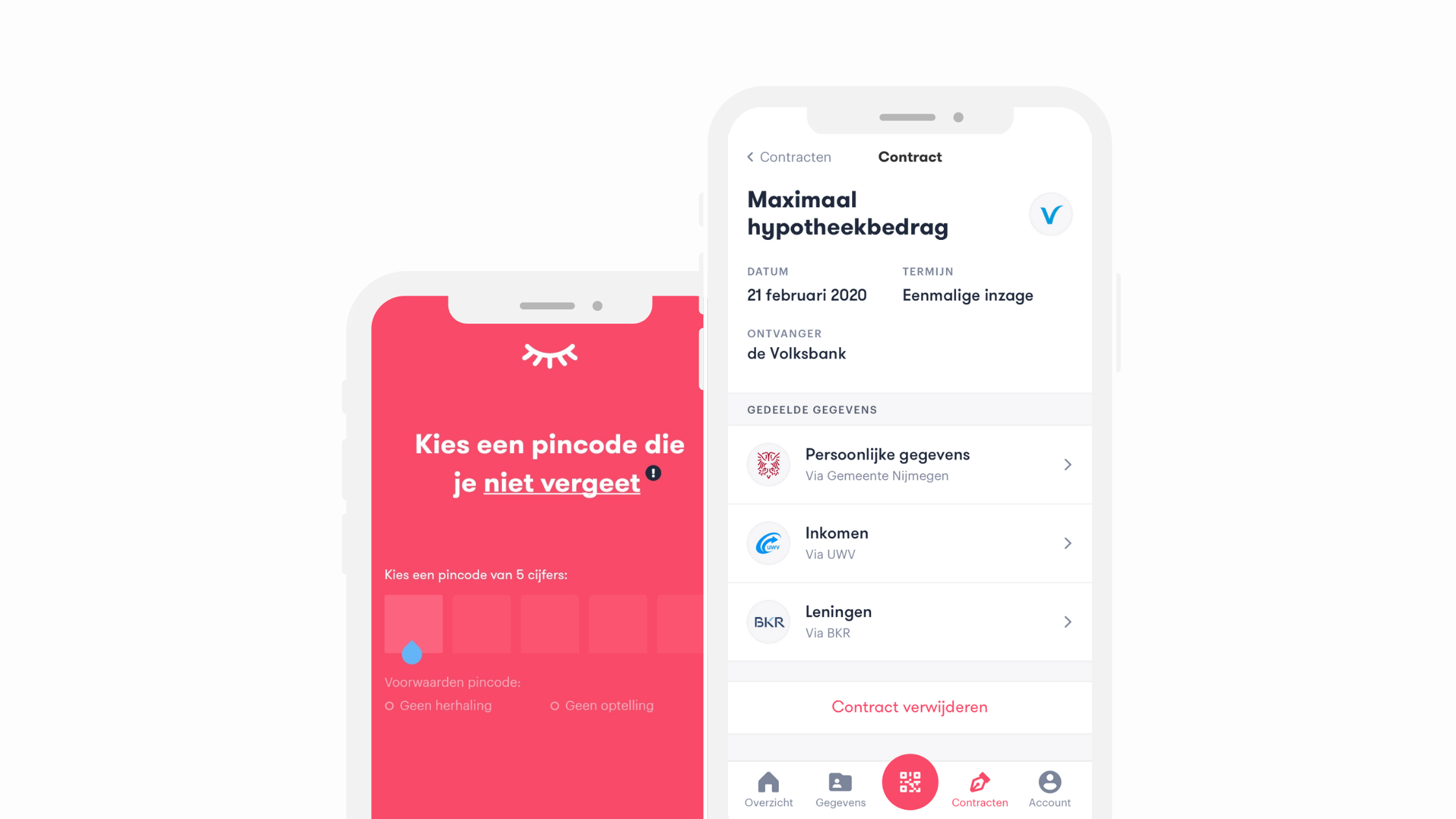

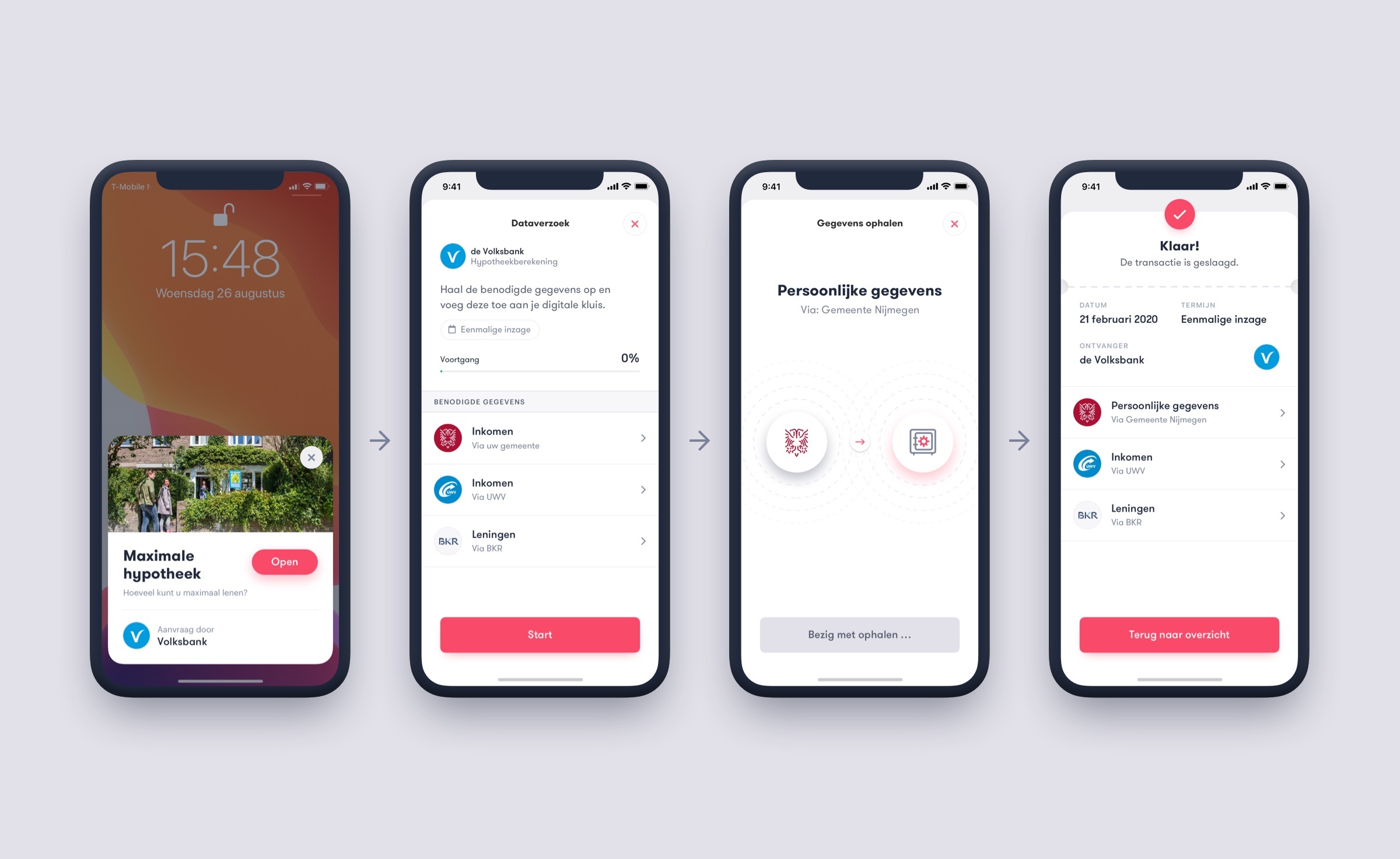

Early on in the approval process, during the mortgage consultation, the customer downloads the Schluss app and creates his or her own digital vault. Then, he or she scans a QR code and receives a data request from de Volksbank.

Peter: “In that request we ask you to grant us access to view, such information as income or outstanding student loans. First, the Schluss app checks whether the data is in your vault. If not, you collect all necessary data from the Tax and Customs Administration and other relevant institutions. After that, you give de Volksbank a one-time permission to view that specific data. And it is done.”

Not only is the data quickly retrieved and shared, de Volksbank also only receives the data it needs and, thanks to Schluss technology, the bank knows for sure that the customer is really who the customer says he or she is. All data has been validated and is therefore correct. An extensive check is no longer necessary.

Faster, easier, safer and cheaper

According to Peter, organizing the mortgage process like this has multiple advantages: “It is faster, easier, safer and cheaper, for both the customer and de Volksbank. Above all, the customer stays in control of his or her data. The customer keeps an easy overview of the data in his or her vault and the access granted to organizations; for what purpose and for how long.

Corporate + startup

As we speak, a proof of concept is being developed and tested in practice. Peter: “Customers appreciate that the process has become so much easier. When our mortgage advisor introduces Schluss, customers still have some doubts though. But, because of the recommendation by de Volksbank, they are quickly convinced about using the Schluss app. And our mortgage advisors? They also see the benefits of this new way of working.”

Peter acknowledges the strength of a collaboration between a corporate and a start-up. “It is fantastic to see where we stand right now. I remember meeting Schluss at the Startup Bootcamp in 2017.

It was immediately clear that we shared the same dream. In the years that followed, we shaped and refined de Volksbank’s data vision. We conceived proof of concepts, executed, tested and validated them. We went through the innovation cycle together. By experimenting together, the solution evolved.

Because of Schluss, not only did we look at our own part as a bank, but also at the bigger picture: how does a healthy data ecosystem work? ”

Not only a money company, also a data company

Peter: “As a bank, we recognize that we are not only a money company, but also a data company. If the data about our customers is validated – as with Schluss, we know better with whom we are doing business. And that way, we can really help the customer better.

At the Volksbank, it has always been about the customer. As a social bank, we want people to be financially self-reliant. Since we are also a data company, our customers should therefore be independent in terms of their own data. Our vision on data and privacy is: as a customer you have control over your own data. Your data, you decide.

The need for this rethinking has been around for a while. In 2018, people were really shaken up after the Cambridge Analytica scandal. The data company collected the data of millions of Facebook users without their knowing.

“The topic of data and privacy is on the rise and the way we view data is changing. That is why we as a bank have to innovate”

Also, with the arrival of the GDPR (General Data Protection Regulation) the privacy laws in the European Union are getting stricter. As a company, if you are to process and use personal data you need a valid reason.

In addition, as a consumer you have the right to access data that were previously inaccessible to you, stored by governments, banks or healthcare providers. The topic of data and privacy is on the rise and the way we view data is changing. That is why we as a bank have to innovate and increase the reliability of data. This is possible if the customer remains the owner of his data.”

Note from Schluss

The collaboration with de Volksbank means a lot to us as the Schluss team. Just like de Volksbank, we felt the potential for a long-term relationship from the start. We share the same vision: giving people back the right to decide for themselves about their own data. It is inspiring that de Volksbank wants and dares to think differently. That’s why we fit together so well. Cheers on even more acceleration!

Do you also want to put your customers back in control of their data (in accordance with the GDPR) and improve your service or product at the same time? We would love to hear from you.

See also